Pivot Completes Management Buyout and £100m+ Debt & Equity Transaction with Foresight Group

Pivot Completes Management Buyout and £100m+ Debt & Equity Transaction with Foresight Group

Pivot Lending Ltd (“Pivot”), a specialist development finance lender, is pleased to announce the successful completion of a Management Buyout (MBO), accompanied by a significant debt commitment from funds managed by Foresight Group (“Foresight”), a leading regional private equity, private credit and real assets manager. .

This milestone transaction significantly strengthens Pivot’s capital structure, widens its shareholder base, expands its funding capacity, and enhances its ability to support SME property developers across the UK.

Transaction Highlights

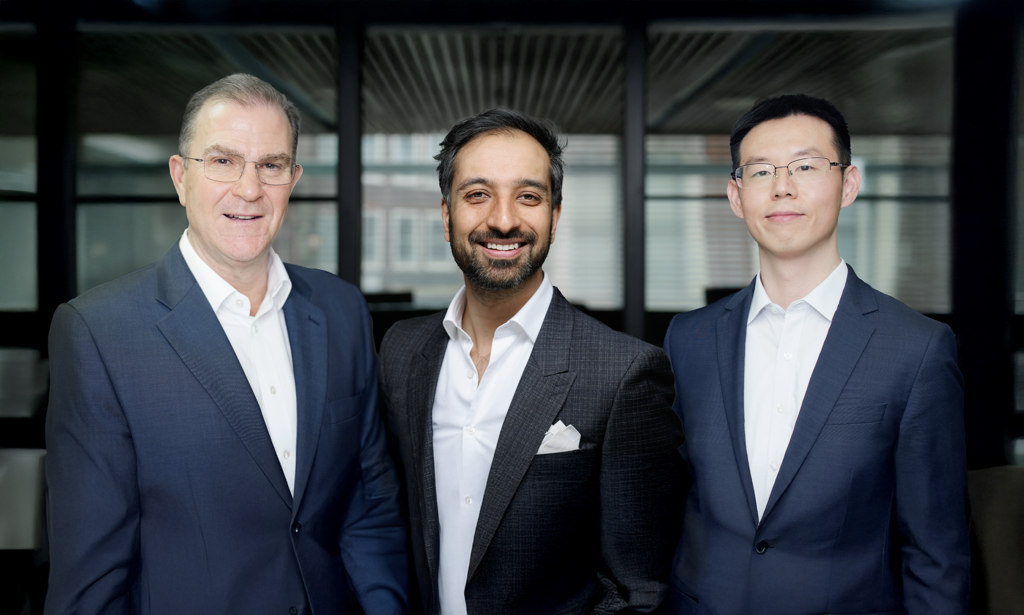

MBO process and capital raise led by Pivot CEO Shahil Kotecha and Capital Director PakSan Wu

Graham Emmett transitions to Non-Executive Chair, as part of the transaction.

£100m+ debt facility and equity investment provided by Foresight.

The transaction enables Pivot to offer more competitive pricing and significantly larger loan sizes to its customers.

Strategic Rationale

The combined MBO and capital package allows Pivot to:

Increase maximum loan sizes to £15m, supporting larger or, more complex short-term finance and development schemes.

Expand its development offering across property types including residential, PRS, commercial, care, PBSA, and hospitality sectors.

Support more SME developers through improved flexibility and capital availability.

Strengthen operating systems, risk frameworks, and data‑driven analytics to enhance speed of decision making.

Leadership Commentary

Shahil Kotecha, CEO of Pivot, said:

“Foresight has been a trusted senior lender to the business for the past two years, and this deepened partnership reflects their confidence in our platform, our governance, and our long-term vision. This new capital base enables us to accelerate our growth; by scaling our loan book, expanding our product suite and enhancing our technology.”

Oliver Bates, Director, Foresight Group, commented:

“The transaction is an important strategic investment for Foresight’s private credit offering, highlighting our ability to invest at scale and across the capital structure into high quality specialist lenders. Pivot has built an impressive presence in the development finance market and we are delighted to back a team with strong sector capability and a clear vision for market leadership.. We look forward to supporting Shahil, Graham, PakSan and the wider team as they accelerate growth and broaden their offering to developers across the UK.”

Pivot completes management buyout and secures £100m-plus backing

Pivot secures £100m+ Foresight backing following management buyout | BLD

industryslice.com/newsletter/78_1211

Pivot Lending completes management buyout and secures funding